How "No Tax on Tips" Could Backfire

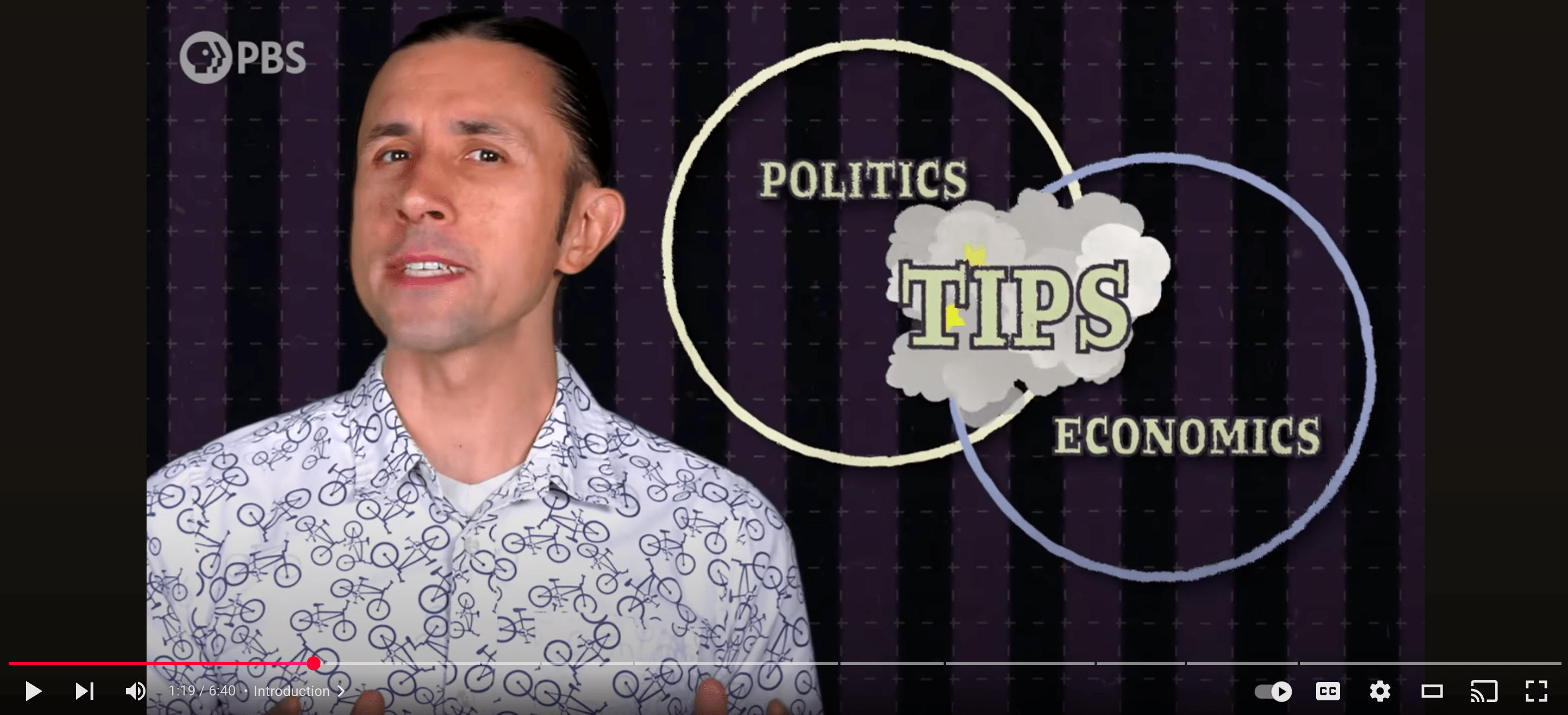

“No Tax on Tips” seems like it’s a good thing… right?? Philip and Julia from PBS’ Two Cents investigate why economists are arguing no!

How “No Tax on Tips” Could Backfire peels back the layers behind the policy and looks at what the broader impact really is.

Questions:

- What does the new tax policy on tips actually do, and who benefits most from it?

- Do you think it’s fair that only tipped workers get this tax break? Why or why not?

- What are some potential unintended consequences of making tips tax-free?

- Why do you think companies like Uber and DoorDash strongly support this law?

- The video suggests other ways to help low-income workers, like raising the minimum wage or expanding tax credits. Which of these approaches do you think would be most effective, and why?

Bonus: Join Julia and Philip LIVE

Join the NGPF Speaker Series on Thursday, October 9 at 4pm PT/7pm ET where they’ll share some fresh financial insights.

Supplement this video with NGPF resources:

About the Author

Sonia Dalal

Sonia has always been passionate about instruction and improving students' learning experiences. She's come a long way since her days as a first grader, when she would "teach" music and read to her very attentive stuffed animals after school. Since then, she has taught students as a K-12 tutor, worked in several EdTech startups in the Bay Area, and completed her Ed.M in Education from the Harvard Graduate School of Education. She is passionate about bringing the high quality personal finance content and instruction she wished she'd received in school to the next generation of students and educators. When she isn't crafting lesson guides or working with teachers, Sonia loves to spend her time singing, being outdoors, and adventuring with family and friends!

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS