Question of the Day: What percentage of people get financial advice from social media?

One stat before you answer - the financial advice hashtag #FinTok has over 4.7 billion views on TikTok!

Answer: 20%

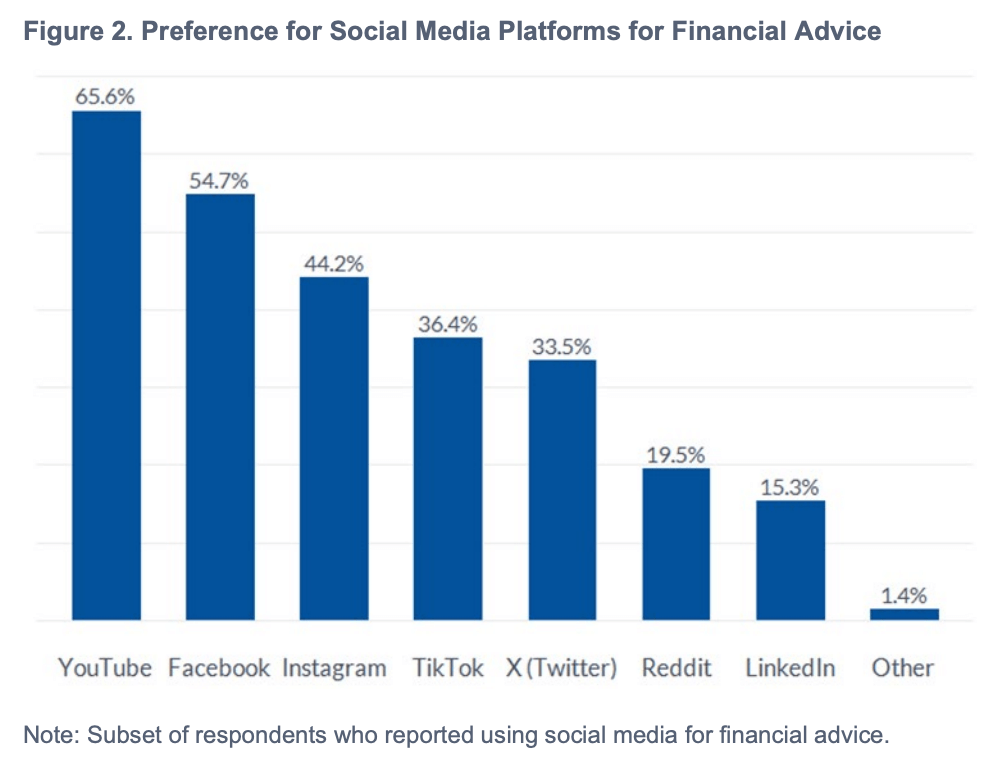

20% of all adults use social media for financial advice. Among people aged 18-35, that number jumps to 38%. The most popular platforms are Youtube, Facebook, and Instagram.

Questions:

- What, if anything, have you learned about personal finance from social media?

- Why do you think young people are more likely to get financial advice from social media?

- How can you determine if financial information is credible (ie. trustworthy)?

Here's the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Federal Reserve Bank of Philadelphia):

"Social media has become a popular source for financial advice. Surveys indicate that people, especially those in younger generations, are increasingly turning to social media platforms for advice on various financial topics, including budgeting, saving, and investing...

However, there is a growing concern about the quality of financial information being provided on social media platforms: Some creators of financial content, even those with a large following, may lack professional training or expertise in household finance and are often unqualified to give accurate and reliable financial advice. Moreover, finfluencers are increasingly paid by financial firms to promote certain products and services, which potentially leads them to be more focused on a marketing task rather than offering their followers valid advice"

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS