Question of the Day: What percent of Americans with credit card debt have carried a balance for over 1 year?

Credit card debt can take more money - and time - to repay than you might expect.

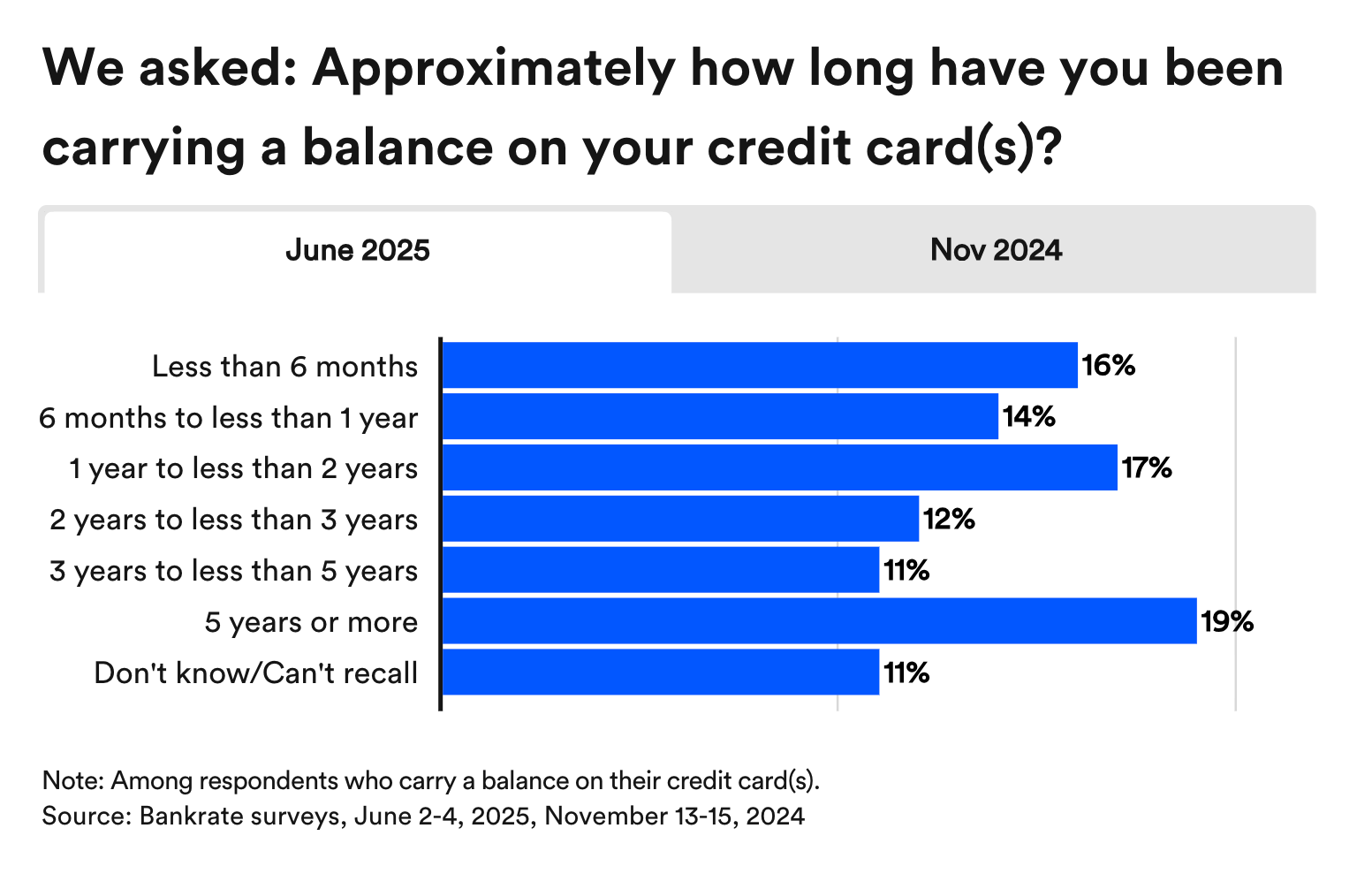

Answer: 59%

Questions:

- Hypothesize: what prevents so many people from paying off their credit card?

- Some people pay the minimum amount (usually about ~3% of their balance) instead of paying the full bill. Is that a good strategy? Why or why not?

- Imagine you ended up with credit card debt that would take a year to pay off. What feelings do you think would come up for you? Why?

- What strategies could you use to pay down a large credit card bill, while still managing other expenses?

Click here for the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the Numbers (Bankrate):

“In November 2024, around half of credit card debtors (53 percent) had carried a balance for at least a year. Now, it’s up to 3 in 5 (60 percent). Another roughly 1 in 5 debtors (19 percent) have carried a balance for at least five years.

Even if you’re making minimum payments on your balance, that may not cut it.

“Minimum payments could keep you in debt for decades and cost you thousands of dollars in interest,” Rossman explains.

For example, the average credit card balance is $6,371, according to TransUnion. If you only make minimum payments, you could be in debt for 217 months and pay $9,254 in interest based on the average interest rate in mid-June of 20.12 percent."

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS