Interactive Monday: How Do Home Values Compare to Incomes In Your County?

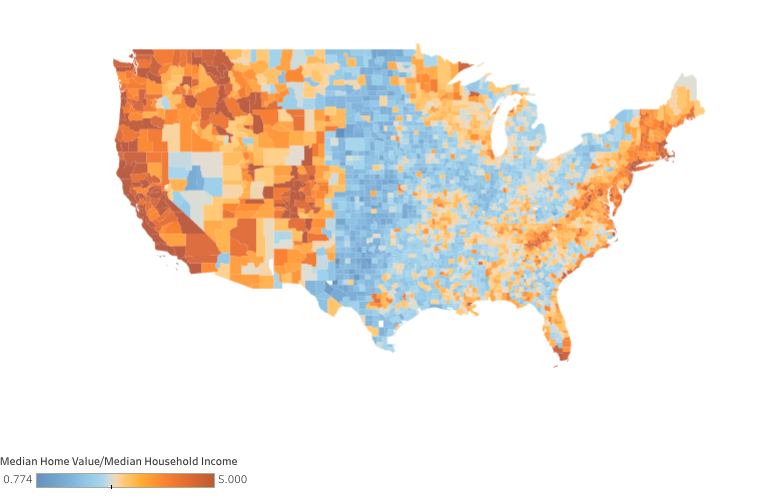

Data visualization provides a county-by-county view on housing affordability. Here's the map of the U.S.:

First, a little orientation. The map is color-coded based on the calculation of median home value divided by the median household income. As an example, here's Crook County, Wyoming:

The higher the ratio, the lower the housing affordability. In terms of the color-coding, blue is more affordable while orange-red is least affordable.

Questions:

- What housing affordability trends do you see when you look at the national map?

- How affordable is housing in your county based on the ratio of median home value to median household income?

- How does your county compare with other neighboring counties?

- Why do you think that median household income is important when determining housing affordability?

- What do you think is a reasonable amount of your monthly income that goes toward paying for housing (rent or mortgage)?

- What factors determine home values in your county? In other words, what determines whether one home is worth more than another?

Extension: Calculate the monthly payment on the median home value as percentage of monthly income in your county (using Crook County, WY as example):

- Use $205,800 as home value

- Using mortgage calculator

- Assume 30 year mortgage

- Assume 20% down payment

- Assume 5% interest

- Monthly payment = $1,084

- Monthly income is $60,445/12 = about $5,000 month

- Monthly payment / Monthly income = 1,084/$5,000 = 22%

-------------------

Be sure to check out the NGPF Interactive Library for more engaging activities for your students.

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS