What's the Catch?: The Case of Golden Valley Loan Company

If they won't regulate, we better educate.

Listening to Planet Money podcast (20 minutes) last week about an online lender, Golden Valley Loan, Inc. It was being sued by CFPB for "unfair, deceptive and abusive business practices." Under new CFPB leadership, the lawsuit has been dropped.

So, I went to Golden Valley's website to read the fine print of their short-term, high interest loans to see if I could find the "gotchas."

What a beautiful website...

Here's how they describe their "Honest About Money" terms [bold is mine]:

While a short term loan is not intended to meet long term financial needs, our loans offer a short-term financial resource that is designed to quickly provide needed cash to you. Our loans are structured to be paid off in multiple installment payments on a set schedule. Each installment payment will lower your outstanding loan principal by an equal amount [Editor's note: For typical amortizing loans, your monthly payment will pay off MORE principal over time]. In addition, each payment includes a fee based on the amount of principal you currently owe. [Editor's note: What's the fee?]There is no balloon payment at the end of your loan – when you make your last payment listed on your payment schedule, the loan will be completely paid off. Qualified returning customers may be eligible for rate discounts.

Our loan process is quick and simple. Your application can be completed online and signed electronically and, if you are approved, your funds can be deposited electronically into your account as soon as the next business day.

Repayment is also simple. You can repay your loan using our standard repayment schedule [Editor's note: See below], you can pay additional amounts toward your principal on scheduled payment due dates, and you can pay off your loan in full at any time without penalty.

They have a Financial Wellness Center with five modules powered by EverFi: Checking, Credit Cards, Credit Scores, Identity Protection, Overdraft.

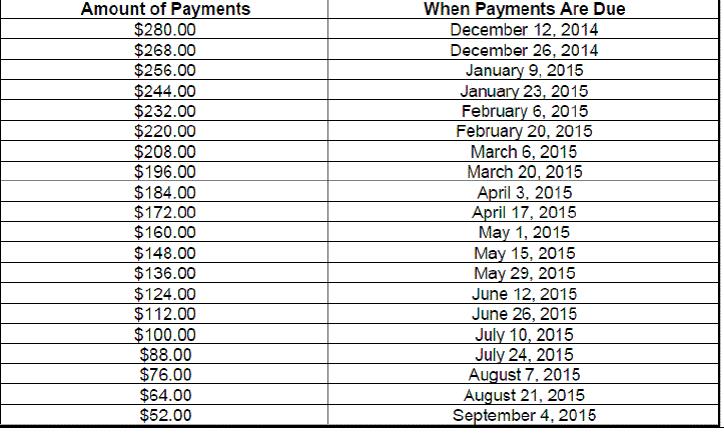

My attempts to find payment schedules, interest rates, loan fees on the Golden Valley website was futile as it appears you need to apply for a loan before you get the "goods" on what you will pay. Luckily, I stumbled upon this payment schedule for an $800 Golden Valley loan made in 2014:

If you were scoring at home, payments for this $800 loan total...drumroll please....$3,204 or 4X the amount borrowed for a 9 month loan. I don't need to calculate the interest rate to know that this is a bad deal. Note that the loan is front end loaded so the lender actually collects more than $800 in just six weeks.

Lest you think the lender actually expects to get repaid by it's borrowers, here's what a spokesperson for Golden Valley has to say on the Planet Money podcast [bold are mine]:

Sure. I - well, we provide a good product that is well-regulated, but it is expensive. We do know that there is a population of the customers we serve that don't have any intentions of paying it back. So the cost of the loan is reflective of the cost to underwrite the customer, the cost to service the customer, the cost to collect and, notably, the cost of the defaults. It's an expensive product, but it is an expensive product to deliver.

We better arm our students with the skills they need to avoid these financial pitfalls. Here's my Activity idea for your students:

- Your friend is very excited about a $800 loan they just received from an online loan company to help make the rent payment for his apartment. He suggests you do the same. The name of the company is Golden Valley.

- Before going to their website, develop a list of questions you want to know the answers to about the loan before applying.

- Now go to their website, and answer the questions you asked.

- Before you make the decision to apply, your friend shares with you his payment schedule [See above]

- How much did your friend borrow?

- What are the total payments he will be making?

- Does this sound like a good deal?

- Will you take your friend's advice and take out a loan from Golden Valley?

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS